|

APPOINTMENTS IN GUARDIANSHIP CASES Two Selected Guardianship Cases Findings from Other Jurisdictions APPOINTMENTS IN RECEIVERSHIP CASES Findings from Other Jurisdictions GUARDIAN AD LITEM APPOINTMENTS Findings in Other Jurisdictions

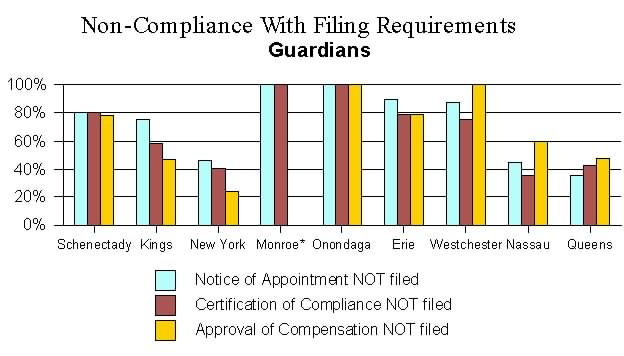

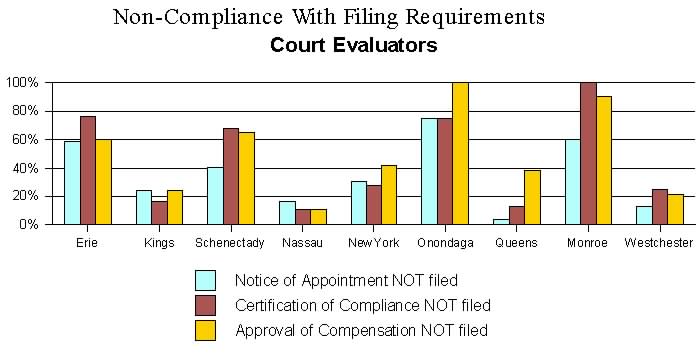

Fiduciaries perform a wide range of functions in the New York courts. Courts, for example, appoint fiduciaries as guardians for incapacitated persons, as receivers for properties involved in foreclosure proceedings and as guardians ad litem for children involved in litigation. Fiduciary appointees are usually private attorneys, who are paid for their services from the assets of the litigants. The fiduciary appointment process has been the target of extensive public criticism over the years, with charges that judges have selected fiduciaries based on factors other than merit and complaints that fiduciary appointees have mishandled cases or received excessive fees from their assignments. Following widely publicized allegations regarding the connection between political party service and receipt of fiduciary appointments in Brooklyn Supreme Court, Chief Judge Judith S. Kaye last year announced a broad program to reform the State's fiduciary appointment process. She created a high-level Commission on Fiduciary Appointments to examine existing rules and practices and make recommendations for improvement. She also established an Office of the Special Inspector General for Fiduciary Appointments, with jurisdiction to monitor and enforce existing rules governing the appointments. This report is based on a comprehensive investigation, involving hundreds of interviews and examination of thousands of court files, by the Office of the Special Inspector General and the court system's Internal Auditing Unit. Most of the individuals involved in the cases discussed in the report were interviewed. The findings have been shared with the Commission on Fiduciary Appointments, which will be releasing its own report and recommendations shortly. The findings are being released now so that the public can more fully understand the basis upon which many of the Commission's recommendations are being made and better evaluate its proposed reforms of fiduciary appointment rules and practice. Brief Synopsis of the Rules The cornerstone of regulatory oversight of the fiduciary appointment process is Part 36 of the Rules of the Chief Judge. Under Part 36, individuals seeking appointment as a fiduciary must submit an application to the Office of Court Administration (OCA). OCA compiles lists of the applicants, which are made available to the judges. Anyone is eligible for inclusion on the lists, except a relative within the sixth degree of relationship of a Unified Court System judge. The rules contemplate that judges will make fiduciary appointments from the lists, although a judge may deviate from the lists in certain circumstances. Part 36 also requires appointees, prior to accepting an appointment, to file with the court a written certification that: (1) the appointee is not related to a judge within the sixth degree of relationship; and (2) the appointment will not result in the appointee receiving within a 12-month period more than one appointment in which the anticipated compensation will exceed $5,000 (the "$5,000 rule"). Within ten days of appointment, appointees must file a notice of appointment with OCA. Additionally, when a judge approves payment greater than $500 to a fiduciary, the judge must file with OCA a statement of approval of compensation specifying the amount. Under the rules, judges are not authorized to approve payment unless the fiduciary appointee has filed the written certification and the notice of appointment. OCA enters information from these filings in the court system's fiduciary database, which is electronically available to judges (along with the applications submitted by fiduciaries and the lists of the applicants). This information is also available to the public. Findings Given the thousands upon thousands of fiduciary appointments made in the New York courts each year, it was not possible to review all cases in which appointments were made. Rather, the investigation focused on a representative number of cases in a representative group of jurisdictions throughout the State. The review concentrated on guardianship cases and receivership cases in Supreme Court and guardian ad litem appointments in Surrogate's Court. Guardianship Cases When a petition for a guardianship is brought, the court must appoint a court evaluator or counsel for the alleged incapacitated person to assist the court in its determination of whether a guardian should be appointed. A guardian will be appointed if the court determines that the individual is incapacitated because he or she is unable to provide for personal needs or property management (or both) and cannot adequately appreciate the nature and consequences of the inability. Our examination revealed a series of problems and concerns in these cases. Compliance with the Part 36 filing requirements was mixed:

The law gives judges discretion to determine the method of the guardian's compensation, and guardians were compensated in a variety of ways. Some received statutory commissions based on a percentage of the assets of the incapacitated person (the "IP") or based on the amounts that the guardian received and disbursed. Other appointees, usually guardians who were lawyers, received hourly fees for their guardian services, in some cases as much as $400 per hour. Still others received both statutory commissions and additional, separate legal fees. And guardians who were not attorneys often retained attorneys to assist them. In many of those cases judges regularly approved separate legal fees for services that appeared to be the statutory responsibilities of the guardian. For example, judges approved legal fees for services such as:

Additionally, when approving fees the courts frequently did not distinguish between legal services and services not legal in nature that should have been billed at a considerably lower rate. For example:

A closer examination of several selected guardianship cases revealed that the guardians apparently did not always act in the best interests of their wards. Serious lapses were found in the quality of care that guardians provided in meeting the personal needs of the IPs. Moreover, guardians apparently did not always strive to promote and preserve the IPs' financial interests, as they were obligated to do as fiduciaries. The investigation further established that many of the recipients of multiple and lucrative appointments in guardianship cases had connections to judges, political parties or court system personnel, raising concerns that they were selected based on factors other than merit. These included:

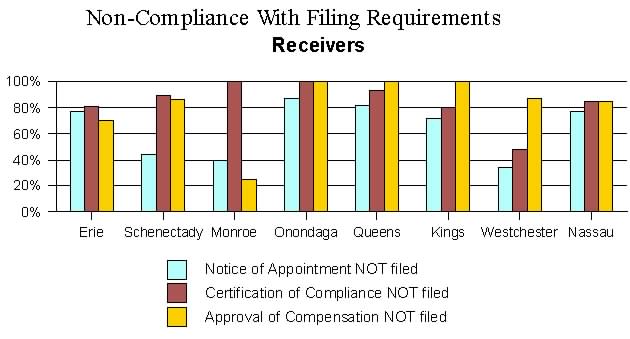

Our review also uncovered a significant number of individuals who received more than one appointment within a 12-month period for which they ultimately were paid more than $5,000, an apparent violation of the Part 36 rules. Receivership Cases Compliance with the Part 36 filing requirements was extremely poor in receivership cases: · In a number of jurisdictions there was minimal filing, particularly with regard to statements of approval of compensation.

In at least one county, a disproportionate number of the appointments and a disproportionate percentage of the fees went to a group of individuals with connections to the local political party establishment. For example:

In general, and contrary to the requirements of the Part 36 rules, receivers, and not judges, appointed their counsel or property managers. Indeed, the general practice across the State was not to apply the fiduciary rules to these "secondary" appointees.

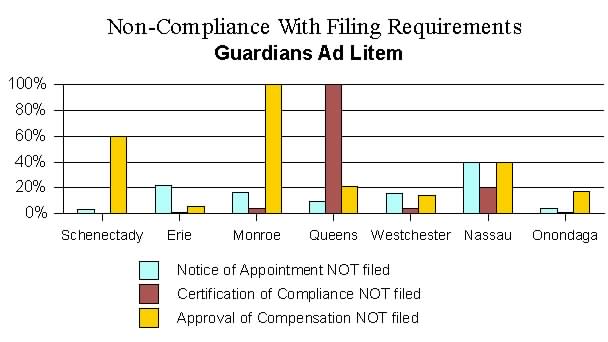

Although counsel were routinely retained in receivership cases, our investigation revealed that the work they performed often was not of a legal nature, involving tasks that the receiver should have been performing such as preparing accountings, preparing billings and meeting with tenants and property managers. Because receivers are compensated at the statutory rate of a maximum of five percent of the amounts they receive and disburse, and the counsel are compensated at their hourly legal rates, the result was that in the smaller receivership cases (which made up the great number of the cases) usually the counsel were awarded higher fees than the receivers. Moreover, in many cases the counsel were compensated for the full amounts they requested even though they failed to detail the work they performed. Similarly, receivers frequently failed to specify expenditures they made, and in some cases they were paid fees that exceeded the five percent statutory maximum. Guardian Ad Litem Appointments In general, compliance with the Part 36 filing requirements in cases in which guardians ad litem were appointed was much better than compliance in guardianship or receivership cases:

In some of the jurisdictions we examined, a disproportionate number of the higher-paying appointments went to a relatively small group of attorneys, who often had some close connection to the court. For example:

Additionally, a significant number of attorneys received guardian ad litem appointments in apparent violation of the $5,000 rule. Conclusion Despite the extensive problems found, we are confident that significant reform of the fiduciary appointment process is underway. First, the Commission on Fiduciary Appointments is about to release its report and recommendations, which will directly address concerns we have raised. Second, to correct the widespread flaws in the fiduciary filing process, the court system has already implemented a new oversight system involving designation of special fiduciary clerks and close monitoring of all aspects of this process. This will better ensure that forms are properly -filed and that fiduciaries are not paid unless the required filings are made. Third, clear violations of the fiduciary rules and ethical standards that we have identified have resulted in referrals to appropriate disciplinary authorities. This is sending strong message to the bar and bench that violations of these important rules will not be tolerated. Finally, the Office of the Special Inspector General has been established as a permanent entity within the court system, and we are continuing our efforts to promote compliance with the fiduciary rules and facilitate greater public confidence in the fiduciary appointment process.

Courts have long relied on fiduciaries to perform a range of functions in our justice system. For example, courts appoint fiduciaries as guardians for incapacitated persons, as guardians ad litem for children involved in litigation and as receivers for properties involved in foreclosure proceedings. Fiduciary appointees are usually private attorneys, but unlike private attorneys who are assigned to represent indigent persons in criminal, family and other proceedings, fiduciaries are not compensated with public funds. Rather, they are usually paid from the assets of the litigants. Allegations that judges have selected fiduciaries based on factors other than merit have undermined public confidence in our courts, as have charges that fiduciary appointees have mishandled cases or received excessive fees from their assignments. Criticism of the fiduciary appointment process soared recently with the public disclosure of an extraordinary letter written by two attorneys who had been retained but then dismissed as counsel to a court-appointed receiver in a Brooklyn Supreme Court proceeding. The letter laid bare the long-suspected influence that political connections can have on the fiduciary appointment process. This time, however, the allegations of political influence came from an unlikely source--disgruntled attorneys seeking to perpetuate their receipt of fiduciary appointments, which they considered their entitlement based on their service and loyalty to the county political organization. In the wake of these developments, Chief Judge Judith S. Kaye announced a comprehensive program to reform the fiduciary appointment process in New York. She directed the establishment of an Office of the Special Inspector General for Fiduciary Appointments, with Statewide jurisdiction to monitor and enforce the existing rules governing judicial appointments. She also created a high-level Commission on Fiduciary Appointments to examine existing fiduciary rules and make recommendations for improvement. This report is based on a far-reaching investigation conducted by the Office of the Special Inspector General for Fiduciary Appointments and the Unified Court System's Internal Audit Unit. As part of this investigation, we have examined thousands of court files and conducted hundreds of interviews with individuals directly involved in or knowledgeable about the process of appointing fiduciaries. Most of the individuals involved in the cases discussed in the report were interviewed. We have also reviewed extensive information in the Unified Court System's fiduciary appointment database. Comprehensive investigation of the fiduciary appointment process is a huge undertaking--in any given year, thousands upon thousands of fiduciary appointments are made in the New York courts. We have not examined all of these appointments, nor would it be possible to do so. What we have done in this report is present our findings with regard to a representative group of cases and jurisdictions. In doing so, we have identified a series of problems and concerns that require the attention of court administrators, policy makers and, perhaps most importantly, the Commission on Fiduciary Appointments, which will be issuing its report and recommendations in the next several days. The Commission's report will include recommendations for rule changes that will be considered by the Administrative Board of the Courts and ultimately by the State's highest court, the Court of Appeals. Throughout our investigation, we have shared our findings with the Commission. This report is being released now so that the public will understand the basis upon which many of the Commission's recommendations are being made and thus can better evaluate the forthcoming proposed changes in fiduciary appointment rules and practice. Finally, except when discussing certain matters that already have received extensive attention in the media, we have not identified individuals whose actions are described in the report. As noted, the purpose of this public report is to provide a factual context for recommendations to improve the process, not to make accusations against people who may have committed misconduct. This would be an inappropriate forum in which to do so. Rather, under the State Constitution (N.Y. Const., Art. 6, § 28) and statutory law (Jud. Law §§ 212(1)(h), (m), (s) and (t)), and pursuant to the authority and direction of the Chief Administrative Judge of the Courts, our investigation has resulted in referrals to appropriate disciplinary authorities, with additional referrals currently under consideration. The law provides that these are confidential processes in which the subjects are not revealed unless they waive their statutory right to confidentiality or unless a finding of misconduct is made. Although many have long urged that disciplinary charges against judges and lawyers be made public at an earlier point, as of yet there has been no legislative action in that regard.

The cornerstone of regulatory oversight of the fiduciary appointment process in New York is Part 36 of the Rules of the Chief Judge (see 22 NYCRR Part 36). Promulgated in 1986, the Part 36 rules apply to the appointment of guardians, guardians ad litem, court evaluators, attorneys for alleged incapacitated persons, receivers, persons designated to perform services for a receiver and referees. Under the rules, individuals interested in being considered for appointment must submit an application to the Office of Court Administration. OCA compiles lists of the applicants, which are made available to judges who must make the appointments (§ 36.2(a)). Anyone is eligible for inclusion on the lists, except a person who is a relative of, or related by marriage to, a judge of the Unified Court System within the sixth degree of relationship (§ 36.1(b)(1)).1 Thus, although the application that a prospective fiduciary appointee submits to OCA contains extensive information about the applicant, such as prior experience, education, employment history, area of expertise and criminal record, the only factor that renders an applicant ineligible for inclusion on the list is relation to a judge within the sixth degree. The rules contemplate that judges will make fiduciary appointments from the list. A judge may deviate from the list, however, if the appointee "is better qualified for appointment in a particular matter, either because of prior experience with the ward or estate, or because of particular expertise necessary to the case." When deviating from the list, the judge must place the reasons for doing so as well as the appointee's qualifications on the court record (§ 36.1(a)). The rules provide generally that the appointing judge is "solely responsible" for determining the qualifications of a fiduciary appointee. Part 36 sets forth strict filing requirements for fiduciaries. Before accepting an appointment, a prospective appointee must file with the court a written certification that the appointment will not violate the Part 36 rules (UCS Form 830.3; see § 36.1(d)). In essence, this is a certification of two facts. First, as noted, it is a certification that the prospective appointee is not related to a judge within the sixth degree. Second, it is a certification that the appointment will not result in the appointee receiving within a 12-month period more than one appointment, calculated from the date of appointment, in which the anticipated compensation will exceed $5,000. The prospective appointee's certification must also include a list of any fiduciary appointments received within the preceding 12 months. If the appointee is unable to make this certification, the judge is not authorized to make the appointment, with one limited exception. The judge may waive the $5,000 rule upon determining, in writing, that "unusual circumstances of continuity of representation or familiarity with a case require" the appointment (§ 36.1(c)). Within ten days of receiving an appointment, the fiduciary must file with OCA a "notice of appointment" form (UCS Form 830.1; see § 36.3(a)). The filing provisions, however, do not apply to every fiduciary appointee. Section 36.1(e)(3) provides that the provisions do not apply to the Mental Hygiene Legal Service, a nonprofit institution performing social services or an appointment of a relative or a person having a legally recognized duty or interest with respect to the affairs of the infant, ward, incapacitated person, decedent or beneficiary of an estate. When the judge approves payment in excess of $500 to any fiduciary, including family members and social service agencies, the judge must file with OCA a "statement of approval of compensation" specifying, among other things, the amount of compensation authorized (UCS Form 830; see Jud. Law § 35-a, 22 NYCRR Part 26).2 The statement of approval of compensation also includes a certification by the fiduciary that he or she submitted a notice of appointment form to OCA, and a certification by the judge that the fee authorized is fixed by statute or is a "reasonable award" for the services rendered (§ 26.4). The rules further provide that no fee shall be awarded unless the fiduciary has filed the notice of appointment form and the certification of compliance (§ 36.4(c)). OCA enters information from these filings in the Unified Court System's fiduciary database, which, along with the applications submitted by prospective fiduciaries and the lists of the applicants, is now available to judges on the Judiciary's internal computer network. This information is also available to the public. Since its promulgation in 1986, Part 36 has included within its ambit "persons performing services for a receiver." Section 36.1(a) provides that their appointments, like those of receivers, guardians and the other fiduciaries enumerated in that section, "shall be made by the judge authorized by law to make the appointment." All of the disqualifying factors, filing requirements and other provisions of Part 36, therefore, apply with equal force to such persons. Thus, receivers cannot appoint their own counsel or property managers, judges may not appoint relatives of judges to those positions and the appointees must make all the filings required by Part 36. Despite the clear mandate of Part 36, a practice evolved in the courts in which the receivers, and not the judges, selected their own counsel and property managers in cases in which the receivers determined it was advantageous to retain these professionals. To correct this widespread noncompliance with the rules, Chief Administrative Judge Jonathan Lippman in March 2000 issued a memorandum reiterating for judges across the State that appointments of persons designated to perform services for a receiver must be made by the judge, and that such appointments were subject to all the requirements of Part 36 (see Attachment A). The Rules of Judicial Conduct also address fiduciary appointments. The rules provide that a judge "shall not make unnecessary appointments . . . . shall avoid nepotism and favoritism . . . . [and] shall not approve compensation of appointees beyond the fair value of services rendered" (22 NYCRR § 100.3(C)(3)). The rules also provide generally that a judge "shall act at all times in a manner that promotes public confidence in the integrity and impartiality of the judiciary," and "shall not allow family, social, political or other relationships to influence the judge's judicial conduct or judgment" (22 NYCRR §100.2(A) & (B)).

In General A court may appoint a guardian only after determining that the appointment is necessary to provide for the personal needs of that person and/or to manage the property and financial affairs of that person, and that the person has agreed to the appointment or is incapacitated (MHL § 81.02(a) (1) & (2)). The standard in determining incapacity is whether the person is likely to suffer harm because he or she: (1) is unable to provide for personal needs or property management or both, and (2) cannot adequately understand and appreciate the nature and consequences of the inability. A determination that a person is incapacitated must be based on clear and convincing evidence, and requires a hearing, even in cases where the alleged incapacitated person (the "AIP") consents to the appointment of a guardian (MHL § 81.11(a)). The court also must assess the functional abilities of the AIP in order to properly tailor the guardianship order so that it meets the needs of the individual (MHL § 81.02(c)). A guardianship proceeding (often referred to as an Article 81 proceeding) begins with the filing of an order to show cause and supporting petition. The majority of guardianship petitions are filed by local social services agencies, hospitals and healthcare facilities, with most of the remainder brought by relatives or friends of the AIPs. At the time of issuance of the order to show cause, the court must appoint a court evaluator (unless counsel for the AIP is appointed) (MHL § 81.10 (g)). Court evaluators must be selected from the OCA fiduciary list. In addition, all court evaluators must complete a training program approved by OCA. Although the court may waive this training, that is rarely done (MHL § 81.40(c)). In selecting a court evaluator, the court may choose from a broad spectrum of professions, including attorneys, physicians, psychologists, accountants, social workers, nurses or any other persons the court determines possess the knowledge and skill to perform the task (MHL §, 81.09(b)(1)). Additionally, in cases in which the AIP resides in a state facility, hospital, nursing home or adult home, the court has the option of appointing Mental Hygiene Legal Service ("MHLS") as the court evaluator (MHL § 81.09(b)(2)). The court evaluator acts as an independent investigator and gathers information to aid the court in its determination of the AIP's capacity, the availability and reliability of alternative resources, the proper powers to be assigned to the guardian and selection of the guardian (MHL § 81.09). The court evaluator's specific responsibilities include meeting with and interviewing the AIP to explain the proceedings, the rights to which the AIP is entitled, and the general powers and duties of a guardian. The court evaluator also must interview the petitioner, assess whether legal counsel should be appointed for the AIP and submit a written report providing extensive information with recommendations to the court (MHL § 81.09(c)(5)). All of these tasks must be performed on an expedited basis, because the court must conduct a hearing within 28 days of the filing of the petition (MHL § 81.07(a)(1)). An AIP for whom a guardianship is being sought has the right to be represented by legal counsel of that person's choosing (MHL § 81.10). Although the court also may appoint counsel for the AIP, this is not always required. Appointment of counsel is mandatory, however, if: (1) the AIP requests counsel; (2) the AIP contests the petition; (3) the AIP does not consent to a request in the petition for removal to a nursing home or other residential facility; (4) the AIP does not consent to necessary medical or dental treatment; (5) the petition seeks temporary powers; (6) the court determines that a conflict exists between the court evaluator's role and the advocacy needs of the AIP; or (7) counsel would be helpful to the resolution of the case (MHL § 81.10(c)). Following a hearing, the court may appoint a guardian to attend to the personal needs of an incapacitated person (the "IP") and/or to manage the IP's property and financial matters. In general, courts give preference to a family member or to a person nominated by the IP. If no family members or nominated persons are qualified to serve, however, the court may select an appropriate person to serve as guardian. If the petition is brought by a social service agency and the IP resides or plans to return to the community, a community guardianship program may be appointed as guardian (MHL § 81.19(a)(2)).3 A guardian may exercise only those powers authorized in the appointment order, which must be tailored to the specific needs of the IP. In general, a guardian usually is required to oversee the IP's assets, make health care and medical decisions, pay bills, supervise home health care or select a health care facility, and periodically visit the IP. In addition to providing personal care and managing the IP's finances, the guardian must file periodic reports with the court. These reports should document the IP's financial status, including income, assets, expenditures and unpaid claims, as well as medical condition and health care. The reports are reviewed by court examiners who have been appointed by the Appellate Division (MHL § 81.32). Upon the termination of a guardianship, the guardian must file with the court a final report providing a financial accounting of the entire period during which the guardian served. Compensation of Article 81 Fiduciaries Article 81 prescribes how the court evaluator, counsel for the AIP and guardian are to be compensated (MHL §§ 81.09(f), 81.10(f) and 81.28). Under the statute, the cost of the guardianship proceeding is to be paid by the IP, unless he or she has minimal or no assets. However, if the proceeding is dismissed or discontinued and the court determines that appointment of a guardian is not warranted, the petitioner is usually responsible for his or her own attorney's fees and possibly even the fees of the court evaluator and counsel to the AIP. If an AIP is indigent, the Court of Appeals has held that the cost of attorney fees should be borne by the county pursuant to Article 18-B of the County Law.4 And in cases commenced by local social service agencies in which there are minimal or no assets, the court evaluator receives a stipend of $600, to be paid by the petitioner. Typically, if the AIP has some or substantial assets, the court evaluator and the counsel for the AIP are paid a fee from those assets based on the fair and reasonable value of the services rendered. When determining reasonable compensation for a court appointee, the court generally must consider the following factors: time spent, difficulty involved, nature of the services, amount of assets involved, professional standing of the counsel and results obtained.5 In making this determination, the court should rely on detailed time records submitted by the court appointees. Compensation for the guardian is addressed in MHL § 81.28, which provides that the court shall establish a plan for reasonable compensation of the guardian. While the statute suggests that the court may use Surrogate's Court Procedure Act (SCPA) § 2309 in setting compensation, that provision is merely a guideline and is not binding, particularly when the primary responsibilities of the guardian involve personal care. In some counties, the courts rely on a variety of methods when determining guardian compensation. Some judges determine a guardian's compensation based on a percentage of the amounts received and disbursed, or on a percentage of the principal, coupled with additional hourly compensation for any legal services rendered in connection with the appointee's official duties as a guardian (SCPA §§ 2307, 2309). In the alternative, some judges authorize compensation for guardians based entirely on an hourly rate. If a community guardianship program is appointed guardian, its compensation is determined pursuant to section 473-d(3)(d) of the Social Services Law and the Mental Hygiene Law.6 We examined all guardianship cases commenced in New York County Supreme Court between January 1, 1999 and December 31, 1999--a total of 338 cases. We reviewed 335 of these cases (three of the court files were not available). In about one-third of these cases the NYC Department of Social Services was the petitioner; in the remaining cases the petitioners were a health care facility, a hospital, or a friend or relative of the AIP. In addition to examining the court files, we reviewed information relating to these cases contained in the Office of Court Administration's fiduciary database, and we interviewed judges, court personnel and many of the fiduciary appointees in these cases. Our investigation of these cases revealed the following:

Of the 285 court evaluators required to file the Part 36 forms, 196 (69%) filed a notice of appointment, and 206 (72%) filed a certification of compliance. In total, 250 court evaluators awarded compensation by the court were required to file their statement of approval of compensation forms. In 146 (58%) of these cases, a statement of approval of compensation form was filed with OCA. In a number of the cases in which forms were not filed with OCA, a form was in the court file, although many were incomplete. As noted, the court evaluator's fee is determined by the judge based on reasonable compensation for services rendered. In many of the cases we reviewed, judges awarded to court evaluators who were attorneys compensation at their hourly rate for legal services even though the work performed was not legal in nature. Generally, hourly rates ranged from $150 to $275 per hour. Additionally, in some cases, court evaluators charged over $300 an hour for performing basic administrative tasks usually done by support staff. In some cases, they spent numerous hours working on routine matters. In the cases we examined in which the IP had assets, the court rarely reduced the fee requested by the court evaluator. The following are some examples:

Although the court evaluator appointments were divided among 199 individuals, a much smaller group of individuals--23 (12%)--received over 50% of the total compensation awarded. Many of these individuals had connections either to each other or the political establishment. For example, two of the appointees were associates at the same small law firm, two were counsel to and one was an officer of a county political party committee, and one employed a county political party leader. As discussed, not every guardianship proceeding requires the appointment of a counsel for the AIP. The court appointed an attorney for the AIP in only 130 of the cases reviewed (in three of those cases a successor attorney was appointed). In over half of these cases, the court appointed Mental Hygiene Legal Service as the attorney. The other 64 appointments were divided among 47 attorneys. While most of the attorneys only received one appointment, a few were appointed in two or more of the cases. In total, only 56 of those appointed were required to file the Part 36 forms. Of these, 33 (59%) filed a notice of appointment and 32 (57%) filed a certification of compliance. In the 46 cases in which the attorney was awarded compensation, only 25 (54%) statements of approval of compensation were filed. While 35 attorneys were awarded compensation, a much smaller group of attorneys received most of the money. Six attorneys received more than 70% of the total fees awarded. Two of these attorneys, one a former judge and the other a high-level local bar association officer, were each awarded fees in excess of $50,000 in two cases. By comparison, none of the other 29 attorneys was awarded a fee over $6,000 in any one case. In 129 (46%) of the cases reviewed in which a guardian was appointed, the court selected as the guardian a friend or family member of the IP. In over 20% of those cases, the court appointed a private attorney to act as the co-guardian. Usually, a friend or family member was appointed as co- guardian to handle the IP's personal needs, and the attorney co-guardian managed the IP's property and financial matters. In 29% of the proceedings, a community guardianship program was appointed guardian. In a few cases, a successor guardian was appointed either to replace a community guardianship program when the IP was placed in a health care facility or when a guardian was discharged or resigned. In 53 (16%) of the proceedings, a guardian was not appointed. In some of those cases, the petition was withdrawn prior to the hearing, and in others the court determined after the hearing that a guardian was not necessary. Of the 111 guardians required to file the Part 36 forms, only 60 (54%) filed a notice of appointment, and only 65 (59%) filed a certification of compliance. In total, 41 guardians were awarded compensation. Of these cases, the court filed the approval of compensation form in 31 (76%) of the cases. As discussed, the courts use a variety of methods in determining a guardian's compensation. Generally, the fee arrangement is determined at the time of appointment. Some judges, however, delay choosing a method of compensation until completion of the guardianship or when payment of the guardian is warranted, such as after the review of the annual report by a court examiner. An examination of the cases revealed that the majority of judges calculated the guardian's compensation based on the statutory commissions while a few judges set a fixed hourly rate for the guardian. Other judges did not commit to a method of compensation, and noted in the appointing order that the guardian's commission was to be based on either SCPA § 2307 or SCPA § 2309, "whichever was higher." In cases where a family member or friend was appointed guardian, compensation was frequently waived. For 104 (29%) guardians compensation was based on a statutory commission. For 66 (19%) guardians, compensation was based on an hourly billing rate ranging from $10 to $450 per hour. For 59 (17%) guardians, no method of compensation was specified in the court file, and 49 (14%) appointees waived compensation. For 68 (19%) guardians, commission was determined pursuant to section 473-d(3)(d) of the Social Service Law. The remaining eight (2%) guardian's compensation was paid by the local social service agency. Some judges have expressed dissatisfaction with the compensation provided for guardians under SCPA §§ 2307 and 2309, particularly when the guardian's responsibilities include both personal and property management.7 In response, judges have awarded additional compensation to guardians when they had extensive responsibilities or appointed co-guardians. In setting the guardian's fee, courts have applied factors such as the type and nature of assistance provided to the IP, the amount of time the guardian expended in providing both personal needs assistance and property management and the allocation of time between the personal needs assistance and property management. In some cases, judges approved payment of legal fees in addition to statutory commissions to guardians who were attorneys, even for services that appeared to be responsibilities of a guardian as delineated in the statute. When setting hourly fees, the courts often did not differentiate between legal services rendered and guardianship services such as shopping for clothes and toiletries, paying bills and visiting the IP. The following are some examples:

The investigation revealed that many of the recipients of multiple and lucrative appointments had relationships with judges, court system personnel, politics or in some cases each other. For example:

Two Selected New York County Guardianship Cases Two guardianship cases illustrate the problems discovered in many of the cases reviewed. In the first case, a guardianship proceeding was commenced by the hospital where the AIP, a retired college professor who had suffered a stroke, was a patient. The AIP was seriously ill and the hospital was seeking his discharge so he could spend his final days at home. The court appointed two guardians: an attorney who had regularly served as the judge's special master was appointed to handled the IP's personal needs, and a friend of the IP was appointed to handle the IP's property and financial matters. The IP's friend resigned shortly thereafter and was replaced as co-guardian by a tax and financial manager. A few months after the IP returned home from the hospital, he unexpectedly began to recover from his illness, and soon required much less assistance from the 24-hour home health aides. As he continued to recover, the IP attempted to take a more active role in his financial affairs, and he repeatedly complained about the harsh treatment he was receiving from one of the home health aides. Despite the IP's many requests and complaints, there was no change in his 24-hour health care, the hostile home health aide was not replaced and the guardians provided him with no information about his finances. The IP eventually retained his own attorney, and the attorney filed a motion to terminate the guardianship. In response, the court appointed a court evaluator to investigate and determine whether the IP still needed a guardianship. Following an extensive investigation and a trial period, the court evaluator concluded that the IP was capable of managing his own affairs. In her report, the court evaluator harshly criticized both guardians, and questioned whether the personal needs guardian had fulfilled his fiduciary obligations. Thereafter, the court discharged the home health aides and made arrangements for the IP to resume control of his finances. Although the guardians' day-to-day responsibilities now were no longer required, they continued to bill for another 70 hours, which included time spent researching the placement of the IP in an assisted living facility and the creation of a burial trust. Although he provided no legal services, the personal needs guardian was compensated at his legal billing rate of $215 per hour. The guardian of the property was compensated at a rate of $200 per hour. In all, the guardians spent over $481,000 of the IP's money, with nearly half paid to court appointees. The guardians received over $160,000 combined, nearly $100,000 more than they would have received had they been paid statutory commissions. The judge handling this case subsequently appointed the guardians again in another proceeding. In the second case, a guardianship petition was brought by a niece of the AIP who was concerned about the handling of the AIP's substantial assets by his newly retained attorney. At the time of the petition, the AIP was a wealthy retired doctor who was living at home with his wife of 50 years. The judge appointed a high-ranking local bar association official with whom the judge was friendly as counsel to the AIP, and a friend of the bar association official as court evaluator. Subsequently, the judge appointed the court evaluator as temporary guardian of the IP's property and financial matters and also as temporary personal needs co-guardian with the IP's wife. The temporary guardian then hired the original counsel for the IP (who was no longer needed in that capacity once a guardian was appointed) as his counsel and hired two other attorneys to advise him on other issues. At the same time, the court appointed another attorney, also a close friend of the bar association official, as court evaluator. After the guardians were in place, the court kept the court evaluator in the case to advise the court on financial issues.9 Later, without holding a hearing, the temporary guardians were made the permanent guardians. Over time, tension between the guardian and the IP's family developed. When the guardian questioned the capacity of the IP's wife to serve as co-guardian of the IP's personal needs, the judge temporarily suspended the wife as the co-guardian. The family eventually hired an attorney who, arguing that the animosity between the IP's wife and the guardian was having a detrimental effect on the IP and his family, requested that the court appoint the IP's niece as the sole guardian of the IP's personal needs. The judge declined to remove the guardian, but appointed the judge's personal physician to serve as personal needs co-guardian for the IP. After the family's attorney renewed the request for removal of the guardian, the judge appointed a new counsel for the IP to determine whether the IP wished to withdraw his original consent to appointment of guardian. The family also requested that all fees previously awarded to the guardian and his attorneys be disallowed.10 Shortly thereafter, the guardian resigned. The judge withdrew approval of some of the fees previously awarded and directed the guardian and his attorneys to return a portion of the fees pending further review by the court. The judge then appointed the IP's wife and niece as co-guardians of the IP's property and person and directed the prior guardian to file a final accounting of the proceeding. The judge also withdrew from the case. The new judge then released the court evaluator and the counsel to the IP, and ordered a hearing to determine whether the guardianship was necessary. By the conclusion of the guardian's tenure over $750,000 in fees had been requested by the guardian, his attorneys, accountants and investigative and investment services. The guardian and the second court evaluator each billed at a rate of $300 per hour. The guardian's three attorneys billed at rates ranging from $325 to $400 per hour, often for the same services. For example, the guardian's billing records reveal that a great deal of his time was spent updating each attorney on the work the other attorneys were doing. Additionally, there were numerous meetings and conference calls involving all of the attorneys and the guardian, with each billing for the time spent. In all, the guardian has requested over $277,000 in compensation for services he provided as guardian and as the first court evaluator. The second court evaluator has received almost $60,000 in compensation. The guardian's three attorneys have requested nearly $290,000 in compensation.11 Approximately $200,000 was requested for accountants, investment consultants and investigative services. Findings From Other Jurisdictions In Queens County, we reviewed a random sample of 25 cases in which guardians were appointed. The court appointed Mental Hygiene Legal Service as court evaluator in one case and a family member as guardian or co-guardian in 10 cases. Compliance with the filing requirements was mixed. Although 21 of 24 court evaluators (88%) filed a certification of compliance and 23 of 24 (96%) filed a notice of appointment, only eight of 14 guardians (57%) filed a certification of compliance and nine of 14 (64%) filed a notice of appointment. In addition, only 12 approval of compensation forms were filed for the 23 fiduciaries for which they were required (52%). Guardians were compensated in accordance with SCPA § 2307, SCPA § 2309 or through hourly fees (generally at lawyers' rates). In at least five of the cases in which guardians were paid pursuant to the SCPA, additional hourly fees awarded to guardians appeared to be for duties that the guardian is statutorily required to perform. Some of these routine tasks included:

Moreover, some of the guardians who were attorneys billed hourly rates for all of the guardianship work they performed, which often included time spent visiting the IPs and performing personal chores for them such as shopping for clothing and toiletries. In one case, the following occurred:

Several attorneys received multiple appointments that appear to have violated the $5,000 rule. For example:

A review of the OCA fiduciary database for the period 1995 through 1999 reveals that about a dozen attorneys received many lucrative appointments in Queens County. Some of these attorneys also received lucrative appointments from judges in other jurisdictions, including New York, Kings, Nassau and Suffolk counties. One of the attorneys received approximately 130 appointments totaling over $525,000. Another attorney received 46 appointments in Queens County, of varying amounts, totaling over $130,000. One attorney received 73 smaller cases totaling over $100,000 and another received 46 fiduciary appointments resulting in over $130,000 in fees. A former judge received over 110 fiduciary appointments in a variety of jurisdictions, including Queens, with compensation over $400,000. In Kings County, we reviewed a random sample of 50 guardianship cases. The court appointed a family member as the guardian or co-guardian in 30 of the cases and a non- profit organization as guardian in six of the cases reviewed. The court appointed a total of 24 guardians or co-guardians who were not relatives of the IP or a non-profit organization. Court evaluators filed a notice of appointment form in 38 (76%) of the cases, and a certification of compliance in 42 (84%) of the cases. Only six (25%) of the 24 guardians filed a notice of appointment, and only 10 (42%) filed a certification of compliance. Approval of compensation forms were filed for court evaluators in 32 (76%) of the 42 cases where they were required and in 9 (53%) of the 17 cases where they were required for guardians. As in Queens County, the court awarded compensation to guardians that included both statutory commissions and legal fees. Additionally, the court awarded legal fees for work that is part of a guardian's routine responsibilities. As just one example, the following occurred in a case we reviewed:

We concluded that at least two guardians received appointments in apparent violation of the $5,000 rule. One attorney received three guardianship appointments within a 12-month period that ultimately paid $31,006, $21,286 and $15,000, respectively. Another received two appointments where the compensation was $10,000 and $7,500, respectively. The court files in these cases contained no documentation that the appointing judges waived the rule based on the narrow exception. In Nassau County, we reviewed a random sample of 25 cases in which guardians were appointed. Mental Hygiene Legal Service was appointed as court evaluator in three cases and a family member was appointed as guardian or co- guardian in six cases. Of the 19 court evaluators required to file forms, 17 (89%) filed a certification of compliance and 16 (84%) filed a notice of appointment. Seven of the 11 guardians (64%) required to file forms filed a certification of compliance and six (55%) filed a notice of appointment. Approval of compensation forms were filed on behalf of 17 of the 19 court evaluators (89%) and two of the five guardians (40%) for whom filing was necessary. Our review of these cases revealed the following:

It also appears that several appointees in Nassau County may have violated the $5,000 rule. In these cases, there was no documentation in the court files suggesting that the court found that these appointees met the narrow exception to the rule. In Erie County, we reviewed a random sample of 50 cases in which guardians were appointed. Mental Hygiene Legal Service was appointed attorney for the AIP in one case, court evaluator in five cases and guardian in one case, a nonprofit organization was appointed as guardian in eight cases and a family member was appointed guardian or co-guardian in 28 cases. Three of the 12 counsel for the AIP (25%) filed a certification of compliance and five (42%) filed a notice of appointment; 11 of 46 court evaluators (24%) filed a certification of compliance and 19 (41%) filed a notice of appointment; and four of 19 guardians (21%) filed a certification of compliance and two (11%) filed a notice of appointment. Where approval of compensation forms were required to be filed, three of 7 were filed for counsel for the AIP (43%), 14 of 46 for court evaluators (30%) and three of 14 for guardians (21%). The audit revealed that in many of the cases, guardians were awarded both commissions and legal fees. Some of the fees appear to have been excessive or unsubstantiated. For example:

In Westchester County, we reviewed a random sample of 25 cases. The court appointed Mental Hygiene Legal Service as court evaluator in two cases. Family members were appointed as guardians or co-guardians in 11 of the 25 cases. Of the 16 court evaluators appointed, 12 (75%) filed a certification of compliance and 14 (88%) filed a notice of appointment. But of the eight guardians required to file, only two (25%) filed a certification of compliance and only one (13%) filed a notice of appointment. An approval of compensation form was filed on behalf of 11 court evaluators (79%), but none were filed on behalf of six guardians. In some of the cases we reviewed, appointees received compensation in excess of the statutory fee originally authorized by the court. In one matter, the appointing order specified that the guardian was to be compensated pursuant to SCPA § 2309. Thereafter, the successor guardian received guardianship commissions and legal fees for filing the final accounting. Despite the original court order, the guardian was compensated based on a calculation using SCPA § 2307, rather than SCPA § 2309, resulting in an increase in fees of over $1,000. The guardian also received legal fees for preparation of the final accounting, a task that a guardian should be expected to perform as part of the guardianship commission. In Monroe County, we reviewed a random sample of 25 cases. Mental Hygiene Legal Service was appointed court evaluator in two cases, a nonprofit agency was appointed guardian in 10 cases and family members were appointed guardian or co-guardian in 12 cases. Compliance with the filing requirements was poor. None of the appointees filed the certification of compliance form. Only one of five (20%) counsel for the AIP filed a notice of appointment, while only eight of 20 (40%) court evaluators filed and none of the four guardians filed. Fees were awarded to 20 court evaluators but only two approval of compensation forms (10%) were filed, and five counsel for the AIP were compensated but no forms were filed. No guardians received compensation. It appears from the OCA database that one attorney received appointments that violated the $5,000 rule. The attorney was initially appointed as the court evaluator in one case and awarded over $5,000 and then appointed guardian in that same case for which the attorney earned $17,000; subsequently, the attorney was appointed guardian in another case for which the attorney eventually earned over $13,000. We also reviewed a random sample of 25 cases in Schenectady County. Mental Hygiene Legal Service was appointed counsel to the AIP or court evaluator in five cases, and 14 family members were appointed guardian or co- guardian. Of those required to file the forms, one (25%) counsel for an AIP filed a certification of compliance and two (50%) filed a notice of appointment; seven of the 22 (32%) court evaluators filed a certification of compliance and 13 (59%) filed a notice of appointment; and two (20%) of the ten guardians filed a certification of compliance and two (20%) filed a notice of appointment. Of those appointees for whom an approval of compensation form was required, none were filed for the counsel for the AIP, seven (35%) were filed for the court evaluators and two (22%) were filed for the nine guardians.

In General Under New York law, when there is a risk that a business or property that is the subject of a civil action in a superior court may be "removed from the state, or lost, materially injured or destroyed," a person with interest in the business or property may move for appointment of a receiver to manage the business or property while the action is pending (CPLR § 6401(a)). Generally, the receiver is authorized to take and hold real and personal property and sue for, collect and sell debts or claims (CPLR § 6401(b)). In the most common proceeding in which a receiver is appointed--a mortgage foreclosure proceeding--this means that the receiver is authorized to collect rents and institute or defend lawsuits related to the collection of rent or the eviction of tenants. In general, a receiver's fee, which is paid from the proceeds of the property or business that is the subject of the receivership, may not exceed five percent of the total sums the receiver collects and disburses (CPLR § 8004(a)). In cases in which the receiver's commission, based on the five percent formula, would not amount to $100, the court may authorize a fee of up to $100 for the services rendered. In addition, in cases in which the receiver collects no sums, or is in possession of no sums at the termination of the receivership, the court may authorize a fee based on the services rendered (CPLR § 8004(b)). A receiver "shall have no power to employ counsel unless expressly so authorized by order of the court" (CPLR § 6401(b)). As noted, Part 36 provides that "persons designated to perform services for a receiver" shall be appointed by the court (22 NYCRR § 36.1(a)). If a counsel is appointed, the fees for such appointees must be reasonable. A receiver may also be reimbursed for expenses necessarily incurred in the performance of his or her duties, such as clerical, auditing, legal or other services. If the receiver is an attorney, however, routine legal services should be performed without separate compensation.12 Additionally, if the receiver hires an individual to do work that should properly be performed by the receiver, the receiver's commission should be reduced accordingly.13 A receiver must provide a full accounting and document in sufficient detail the services provided (see generally CPLR § 6404). An illustration of the dynamics of fiduciary appointments in receivership proceedings in Kings County is the case of People of the State of New York v. Cypress Hills Cemetery (Index. No. 38143/93). The Cypress Hills case is not a mortgage foreclosure proceeding, and it is far more complex and protracted than the typical Brooklyn receivership proceeding. Yet the relationships of the fiduciary appointees in this case to the Brooklyn political establishment and to each other are emblematic of the process in many of the more routine receivership cases in Brooklyn. In 1993, the State Attorney General's Office initiated an action in Brooklyn Supreme Court requesting that Cypress Hills Cemetery be placed in receivership because of mismanagement. It was also revealed that the Cemetery Board had permitted over 1,000 bodies to be buried in a "hill" of construction debris that had been created for cemetery plots. Since its inception, the matter has been handled by Supreme Court Justice Richard D. Huttner. Justice Huttner appointed the first receiver for the cemetery in 1993. The receiver then hired the Brooklyn law firm of Garry & Ludwig as counsel to the receiver. The firm was composed of two partners, William J. Garry and Arnold J. Ludwig, and associate Thomas J. Garry, William Garry's younger brother. Arnold Ludwig, a former law secretary to two Brooklyn Supreme Court Justices, is an officer in the Brooklyn Democratic organization and was a member of the County party's law committee. Thomas Garry is also an officer of the Brooklyn Democratic organization and was a member of the party's law committee. William Garry and Thomas Garry, who joined the firm in 1995, are the sons of a Brooklyn Supreme Court Justice. The receiver also hired a property manager to manage the cemetery. Although the first receiver was replaced in 1996, Garry & Ludwig were continued as counsel. Then, in 1998, Justice Huttner replaced the second receiver with Manhattan attorney Ravi Batra. Beginning in 1995, Mr. Batra has employed the Brooklyn Democratic County Leader in an "Of Counsel" capacity. Since then, the number of Mr. Batra's fiduciary appointments has substantially increased. Following his appointment as receiver, Mr. Batra continued to employ the services of Garry & Ludwig and the property manager. On December 6, 1999, however, he wrote to Garry & Ludwig advising that he was replacing them as counsel to the receiver with his own law firm, not only in the Cypress Hills case but also in three other pending cases in which Mr. Batra was serving as the receiver. Conflicting reasons have been offered for the replacement of Garry & Ludwig as counsel. Mr. Batra claims that the firm was incompetent and was attempting to "churn" legal fees. Garry & Ludwig claim that Mr. Batra was motivated by greed. Cypress Hills was a lucrative appointment for all concerned. Since the inception of the case, well over $1.5 million has been awarded to the various receivers, counsel and property manager. From April 1994 through May 1998, the two initial receivers were awarded $128,000 in commissions. Mr. Batra initially sought $117,000 in compensation for the period of June 1998 through November 1998, but his commission was reduced to $31,400. As counsel to the receivers, Garry & Ludwig received approximately $250,000 in fees. Based on a series of one-year contracts approved by the Cemetery Board providing for monthly management fees ranging from $14,500 to $17,100, the property manager has received over $1.2 million in fees for its management of the cemetery. Interviews disclosed that shortly after their termination, Garry & Ludwig sought the assistance of the Brooklyn Democratic County Leader and the Chair of the Brooklyn Democratic Law Committee as intermediaries. When their attempts at resolving the dispute failed, Thomas Garry and Arnold Ludwig sent a letter, dated December 20, 1999, to the Law Committee Chair resigning their positions as members of the Committee.14 As the letter explains: It has become apparent that our diligent work and unquestioned loyalty to the Organization over the many years are clearly not as important as the desires of Mr. Ravi Batra. Although Mr. Batra holds no party or elected position in our County, he has nevertheless imposed himself on the political workings of our Organization for the sole purpose of his own personal financial gain. * * * * [W]e will be unable to continue to represent candidates for elected and/or judicial office free of charge as we have done so in the past . . . . while the Organization sits idly by and permits Mr. Batra to maliciously injure our practice and reputation without consequence * * * * To continue on in our capacity as Law Committee members in light of Mr. Batra's inexcusable actions would be far too much to expect, given the fact that the Organization has permitted an individual with no party position or history in this County to dictate how our Organization is run. . . . Mr. Batra has never assisted the Law Committee on any level whether it be collecting signatures, binding petitions or trying an election law case, etc. In fact, it is unknown as to what Mr. Batra has accomplished in any capacity to benefit our Organization.

The letter concludes: It is unfathomable that such action would be tolerated by any other political organization within this City or State. It is quite evident that permitting Mr. Batra's behavior has severely damaged our credibility and reputation as a political Organization. * * * * We hope that one day in the not so distant future we will be able to work together again when the interests of the Organization are once again paramount to the unfettered demands of one non-contributing individual.

Garry and Ludwig sent copies of the letter to dozens of other party officials. Weeks later, the press obtained the letter, which was also attached as an exhibit to papers filed in the Cypress Hills litigation. Months later, Mr. Batra resigned his appointment as receiver in the case, and he was replaced by the property manager. In September 2000, the cemetery filed a petition in federal Bankruptcy Court seeking reorganization under Chapter 11. Our investigation in Brooklyn Supreme Court concentrated on all mortgage foreclosure cases in which a receiver was appointed between January 1, 1995 and October 31, 2001. Although receivers are occasionally appointed in other types of Supreme Court cases, these appointments overwhelmingly arise in mortgage foreclosures. The investigation identified 468 mortgage foreclosure cases in which a receiver was appointed between January 1, 1995 and December 31, 1999. We reviewed the court files in only 417 of these cases, because the Clerk's Office was unable to locate the remaining 51 files. Of the files we reviewed, many were incomplete, with required forms and information about appointments and compensation either missing or inadequate.15 Additionally, we reviewed OCA's fiduciary appointment database to determine whether the filings required under Part 36 were made in these cases. We also conducted a wide range of interviews with judges, fiduciary appointees, other attorneys involved in these cases and court personnel. In sum, our investigation of these cases revealed the following:

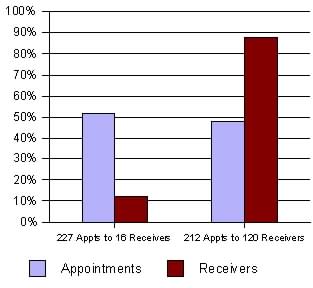

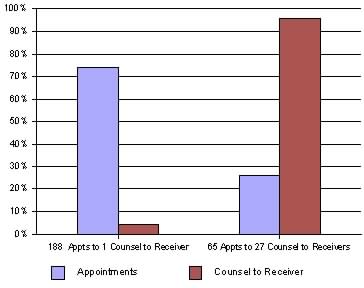

Compliance with Filing and Other Requirements In the 417 cases reviewed, 439 receivers were appointed (successor receivers were appointed in some cases). Of these 439 receivers, only 125 (28%) filed a notice of appointment, while 89 (20%) filed a certificate of compliance. Although, as discussed, the fiduciary rules provide that a judge shall not authorize payment to a fiduciary appointee unless the fiduciary has filed a notice of appointment and a certificate of compliance, our investigation identified no cases in which a judge refused to authorize compensation to a receiver on the ground that filings had not been made. In addition, we found no approval of compensation statements filed in any of the cases we reviewed. We identified 418 "secondary" appointments in the 417 cases we reviewed. Of these, 253 were appointments of counsel and 165 were appointments of property managers. None of these appointees filed a notice of appointment or a certificate of compliance. Moreover, no statements of approval of compensation were filed for any of these appointees. In contrast to these findings of widespread lack of compliance with the filing requirements, the investigation did not reveal widespread violations of the $5,000 rule. Only one individual apparently obtained receivership appointments in violation of this rule. In addition, by virtue of its numerous appointments as counsel to a receiver, the law firm of Garry & Ludwig obtained appointments in violation of this rule. Two management companies, by virtue of their receipt of most of the property manager appointments in these cases, also apparently obtained appointments in violation of the rule. This is more fully discussed below. Appointment of Receivers The 439 receivership appointments made during the period from January 1, 1995 to December 31, 1999 were awarded to 132 people, 109 of whom were on the OCA list of eligible fiduciary appointees for Kings County. Most of the appointees received only one or two appointments. However, a small group of individuals affiliated with the Brooklyn Democratic political organization received a greater number of appointments.16 The following highlights our key findings:

Overall, a group of 16 individuals (which includes the two-partner law firm noted above) received over half of the receivership appointments during the period examined. Additionally, an even smaller number of appointees--six-- received over half of the receivership fees. The appointee with the largest number of appointments received the greatest total amount of compensation--$137,242. The remaining 65 other individual appointees received a total amount of $173,557.

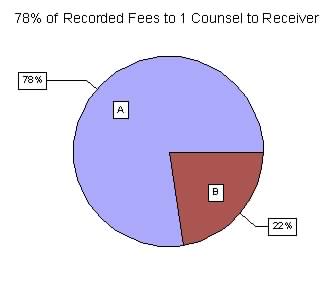

Secondary Appointments In the 417 cases in which receivers were appointed in Kings County during the 1995-99 period, 253 counsel appointments and 165 property manager appointments were made. As discussed, despite the requirements of Part 36, a practice had evolved in the courts in which the receivers selected their own counsel and property managers. In fact, in all of the cases we reviewed in which counsel or property managers were appointed, the appointments were made by the receiver. The qualifications of those appointed were never reviewed by the court. The only cases in which the court reviewed a receiver's decision to appoint counsel or a management agent were those in which a motion opposing the appointment was filed. A primary consequence of this practice was that the law firm of Garry & Ludwig, which actually was ineligible for this work because of the prohibition against relatives of judges receiving fiduciary appointments, was appointed as counsel to the receiver in at least 189 cases, or 74% of the cases in which a receiver retained counsel.17 The firm received $464,554 from these assignments (in addition to the $250,000 it received from the Cypress Hills assignment). By comparison, the other counsel to the receiver appointees received a combined total amount of $130,472.

Two management companies received 63 and 66 appointments respectively, or 76% of the property manager appointments during the period examined. In addition, these two companies received 84% of the fees awarded to property managers (not including the additional money that one received from its Cypress Hills assignment). In their orders appointing receivers, judges addressed the issue of the receiver's authority to retain counsel in a variety of ways. Some judges permitted the receiver to retain counsel for any matter or purpose. Others specified that the receiver was limited to retaining landlord/tenant counsel if it became necessary to bring an eviction or collection of rent proceeding, but was not permitted to retain counsel for any other purpose. Yet other judges, not intending to limit the receiver's authority at all, crossed out provisions in the order that would have restricted the receiver to retaining counsel only for landlord/tenant matters. In many cases in which the appointing order did not authorize the receiver to retain counsel or a property manager, the receiver would hire counsel or a property manager anyway. Subsequently, when the time came for payment in these cases, the counsel would prepare a motion to have himself or herself and the property manager appointed nunc pro tunc (that is, after the time when it should have been done, with a retroactive effect). In some cases opposition papers were filed, with opposing counsel arguing that the receiver had retained counsel and a property manager without court approval and thus they were not entitled to compensation. These arguments, however, were never successful--in all of the cases we reviewed, the court always authorized payment to such appointees retained without initial court approval. Regardless of the language in the appointing orders, receivers in Brooklyn routinely retained counsel. This was true even if the receiver was an attorney and had prior experience as a receiver. An attorney who was a recognized expert in receivership law regularly hired counsel whenever he was appointed as receiver. In fact, in several of the cases reviewed, that attorney and another attorney switched roles--when one was appointed receiver he would retain the other attorney as counsel. The apparent explanation for the great incidence of receivers hiring counsel is a financial one. Our investigation revealed that the nature of the work performed by counsel to the receiver appears to be routine, typically involving review of documents, preparation of accountings and meeting with tenants and property managers.18 Receivers, however, are compensated at the statutory rate of five percent of receipts and disbursements, whereas counsel for the receiver are compensated at their hourly rate for legal services. Thus, in the average Brooklyn foreclosure receivership case, in which the receipts and disbursements tend to be relatively small, compensation for the counsel is usually more lucrative than for the receiver. Even in cases in which little rent is collected, the counsel to the receiver could still earn over five times the amount earned by the receiver by billing for work that was the receiver's responsibility. Indeed, in 85% of the cases in which counsel was retained, the counsel's fees exceeded those of the receiver. In 25 of the cases, counsel earned at least twice as much as the receiver, and in one case the counsel actually earned 75 times as much as the receiver. Property managers also typically earned more than the receivers. In 85% of the cases in which property managers were retained, their fees were higher than the receivers' fees. In 17 cases, the property manager earned at least twice as much as the receiver, and in one case the property manager earned 40 times as much as the receiver. We also reviewed the cases in Kings County in which a receiver was appointed after Chief Administrative Judge Lippman's March 9, 2000 memorandum reiterating that appointments of persons designated to perform services for receivers must be made by the judge and that these secondary appointments are subject to the requirements of Part 36. We focused on the period from April 2000 to October 2001. Our review revealed that the memorandum has reduced, but not eliminated, the longstanding practice in which the secondary appointees are selected and retained by the receiver. Of the 25 cases in which a counsel to the receiver was actually retained:

Of the 24 cases in which a property manager was actually retained:

Compensation As discussed, the CPLR expressly limits a receiver's fee to a maximum of five percent of the amounts received and disbursed (CPLR § 8004(a)). In cases in which this limitation would result in a fee of less than $100, the court may approve a fee of up to $100 for the services rendered (Id.). In many of the Kings County cases we reviewed, judges awarded receivers compensation in excess of these statutory limits. Additionally, in other cases judges reduced the receiver's fee but awarded the counsel to the receiver and the property manager their full fee requests, which were always considerably higher than the receiver's fee. And in some cases in which the receiver collected no rent at all, fees were awarded to the receiver, the counsel to the receiver and the property manager. The following are some examples:

In many cases, counsel to the receiver submitted bills to the court in which their work was not itemized. Frequently, counsel merely informed the court of their hourly rate and then stated the amount of time they had spent on the case. In some cases, the bills simply reflected "court appearance" with a multi-hour charge and no further indication of what had occurred. In some of the final accountings, counsel failed to detail expenditures, stating simply that the receipts and bills were available for review; in others, receivers offered to produce receipts and other documentation but only if an objection was filed. In the cases examined, rarely did the court request specification. Even in cases in which opposing counsel objected to the amount of the fees sought and requested further specification, the court did not require further specification and simply awarded the fees requested. Although opposing counsel occasionally did object to the fees requested, we learned that they generally did not challenge questionable fee requests because they believed it would be futile to do so as well as prohibitively expensive. In many cases, a significant portion of the counsel's bill was for preparation of bills for the receiver and counsel. When required to explain these bills, additional billing resulted. The following are some examples:

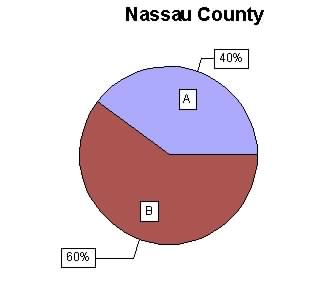

Moreover, in many of the cases reviewed, the receiver and the secondary appointee had a business relationship or were actually the same person. For example, in a number of cases the owner or an employee of a property management company was appointed as receiver and then hired his or her company as the property manager. In other cases, paralegals were appointed receiver and then hired their employers as counsel to the receiver. And in a few cases, the receivers hired themselves or their own law firms as counsel and then were awarded receivership fees and counsel fees. Contrary to what transpired in most of the cases, routine mortgage foreclosure proceedings in which a receiver is appointed do not necessarily require the appointment of a counsel and a property manager. Some receivers performed the necessary work themselves and did not hire counsel or property managers. Receivers in these cases told us they realized that funds might not be plentiful and so they took steps to minimize expenditures. Additionally, in some cases, efforts were made to contain expenses by charging lower hourly rates and by not charging for preparing the receiver's final accounting. Findings From Other Jurisdictions Our review of receivership cases in other counties uncovered many of the same problems we identified in Kings County. Compliance with the filing requirements was poor, many courts authorized payment to appointees without ensuring that the Part 36 forms were filed, very few courts made the secondary appointments and compensation was often excessive, unsubstantiated or in violation of statutory requirements. In Nassau County, where we reviewed a random sample of 25 receivership cases, there was little compliance with the filing requirements. Only four out of 26 receivers (15%) filed a certification of compliance and only six (23%) filed a notice of appointment. Filing of the approval of compensation forms was also poor, with only 15% of the forms filed for the receivers and no forms filed for secondary appointees. Moreover, the court failed to make any of the appointments of counsel or property managers. In fact, many of the orders appointing receivers expressly authorized the receiver to retain a counsel and property manager. Additionally, in two cases the receivers were awarded fees that were higher than the five percent statutory commission rate. In one case, the receiver was awarded double his permissible compensation. In Erie County we reviewed a sample of 24 cases in which 26 receivers were appointed.19 Compliance with filing requirements was inadequate, with only five (19%) of the receivers filing a certification of compliance form and six (23%) filing the notice of appointment forms. Only three of the ten (30%) required approval of compensation forms were filed. None of the property managers, many of whom were not appointed by the court, filed either a certification of compliance or a notice of appointment. Additionally, in several cases the receivers were awarded fees higher than the statutory commission rate. The following are two examples:

In Westchester County, we reviewed a sample of 29 cases in which receivers were appointed. All of the cases were selected randomly from the OCA fiduciary database, because the court maintains no method by which foreclosure cases in which receivers are appointed can be identified. Thus, because cases are entered in the OCA database only when at least one fiduciary form for a case has been filed with OCA, we had no way of precisely measuring the rate at which fiduciary appointees and judges in Westchester receivership cases comply with the filing requirements. We did determine, however, that only 15 (52%) of the receivers filed a certification of compliance (which is filed only in the court file and not with OCA), and that no secondary appointees filed any of the forms. In addition, of the 24 fiduciaries who received compensation--23 receivers and one counsel to a receiver--only three (13%) approval of compensation forms were filed. The court did not appoint most of the counsel and property managers retained by the receivers; in fact, many of the orders appointing the receivers, including receivers who were themselves attorneys, authorized the receiver to appoint a counsel and a property manager. Further, in eight of the cases, the receivers' fees were higher than the statutory commission rate: